UAE Corporate Tax Guide for Investors & Entrepreneurs

The introduction of UAE Corporate Tax has fundamentally transformed the business landscape for high net-worth individuals, investors, and entrepreneurs operating in the Emirates. As the Federal Tax Authority continues to refine regulations and enforcement mechanisms, understanding your UAE Tax Obligations has never been more critical for

Continue ReadingUAE Crypto License Cost: DMCC Requirements & Price Guide

UAE Crypto License Cost 2025: Complete Guide to Pricing, Requirements & Application Process The UAE has emerged as a global leader in cryptocurrency regulation and blockchain innovation, making UAE crypto license acquisition essential for businesses operating in the digital asset space. Understanding the UAE crypto license

Continue ReadingGuide to Offshore Company Formation: Global Opportunities for 2025.

Understanding Offshore Company Formation The landscape of international business has transformed dramatically, making offshore company formation an essential strategy for entrepreneurs, investors, and multinational corporations seeking to optimize their global operations. From the established financial centers of the British Virgin Islands to the emerging offshore hubs in the

Continue ReadingChoosing the right Tax consultant in Dubai

Launching or expanding a business in Dubai is an exciting opportunity, thanks to its booming economy, strategic location, and business-friendly policies. However, even in this low-tax environment, working with the right tax consultant in Dubai is essential to navigate regulatory frameworks, ensure compliance, and support long-term

Continue ReadingLegally Reduce Taxes Through Real Estate Investing in Dubai

Property tax in Dubai like the real estate is not just about acquiring properties or generating rental income, it’s also one of the most effective ways to legally reduce your tax bill. Whether you’re an entrepreneur, high-net-worth individual, or seasoned property investor, real estate investments offer

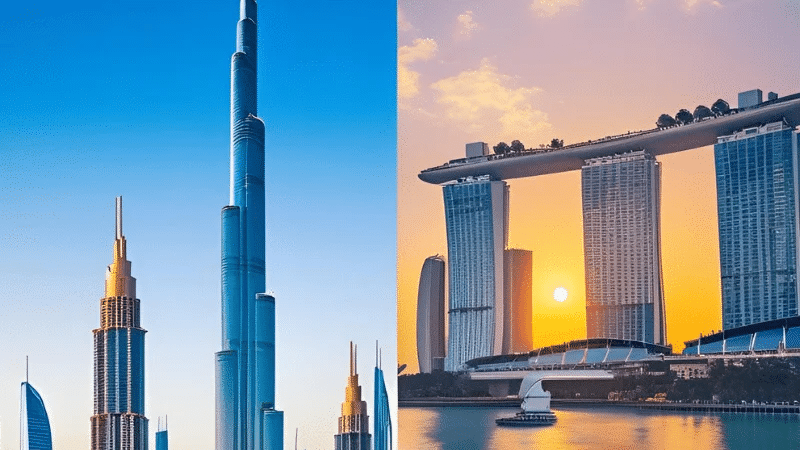

Continue ReadingUAE vs Singapore: Where to Base Your Startup for Tax Savings

Choosing the right base for your startup isn’t just about access to capital or global markets tax optimization plays a key role in long-term success. If you’re a founder, investor, or high-net-worth individual, you already know that taxes can either fuel or stall your business growth.

Continue ReadingTaxes for Non-Doms in the UK: The Ultimate Guide 2025

If you’re a high-net-worth individual (HNWI), investor, or international entrepreneur aiming to legally minimise tax liabilities, understanding the UK tax rules for non-domiciled residents (non-doms) is crucial. The UK’s non-dom regime in 2025 continues to offer significant benefits for individuals with foreign income, overseas assets, and

Continue ReadingLiving in Dubai, UAE: The Ultimate Expat Guide (2025)

Dubai stands out as one of the most unique cities in the world. With ultramodern skyscrapers, a luxurious lifestyle, and high safety standards, it’s a top destination for expats. Over 80% of its population is foreign nationals, making Dubai a global melting pot. It’s a dynamic

Continue ReadingFree Zone Office vs Virtual Office in Dubai

Dubai remains one of the most attractive destinations for startups, thanks to its strategic location, advanced infrastructure, and supportive government services. Dubai’s free zones are recognized as leading business hubs, offering flexible office options and modern facilities. Whether you’re a solo entrepreneur, a service provider, or

Continue ReadingVisa Options for Entrepreneurs in Dubai: Tips and Eligibility

But to fully unlock everything Dubai has to offer, you need the right visa. Choosing the ideal visa ensures not only seamless operations for your business but also a stable and rewarding life for you and your family. This guide dives deep into the visa options

Continue Reading