UAE Corporate Tax Guide for Investors & Entrepreneurs

The introduction of UAE Corporate Tax has fundamentally transformed the business landscape for high net-worth individuals, investors, and entrepreneurs operating in the Emirates. As the Federal Tax Authority continues to refine regulations and enforcement mechanisms, understanding your UAE Tax Obligations has never been more critical for

Continue ReadingChoosing the right Tax consultant in Dubai

Launching or expanding a business in Dubai is an exciting opportunity, thanks to its booming economy, strategic location, and business-friendly policies. However, even in this low-tax environment, working with the right tax consultant in Dubai is essential to navigate regulatory frameworks, ensure compliance, and support long-term

Continue ReadingLegally Reduce Taxes Through Real Estate Investing in Dubai

Property tax in Dubai like the real estate is not just about acquiring properties or generating rental income, it’s also one of the most effective ways to legally reduce your tax bill. Whether you’re an entrepreneur, high-net-worth individual, or seasoned property investor, real estate investments offer

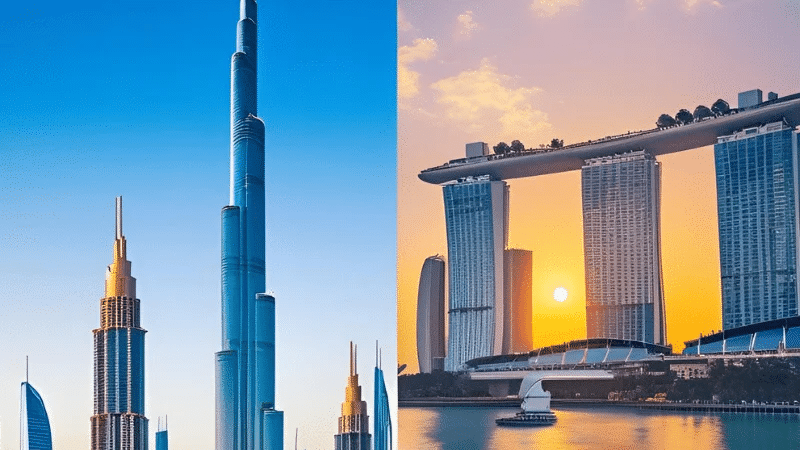

Continue ReadingUAE vs Singapore: Where to Base Your Startup for Tax Savings

Choosing the right base for your startup isn’t just about access to capital or global markets tax optimization plays a key role in long-term success. If you’re a founder, investor, or high-net-worth individual, you already know that taxes can either fuel or stall your business growth.

Continue ReadingTaxes for Non-Doms in the UK: The Ultimate Guide 2025

If you’re a high-net-worth individual (HNWI), investor, or international entrepreneur aiming to legally minimise tax liabilities, understanding the UK tax rules for non-domiciled residents (non-doms) is crucial. The UK’s non-dom regime in 2025 continues to offer significant benefits for individuals with foreign income, overseas assets, and

Continue ReadingWhat Is a Tax Residency Certificate (TRC) in the UAE and How to Get One

Establishing tax residency in the UAE is one of the smartest ways to protect your global income and avoid double taxation. But to make it official, you need a Tax Residency Certificate (TRC). Issued by the UAE Federal Tax Authority (FTA), this certificate lets individuals and

Continue ReadingFreehold vs Leasehold in Dubai: What Every Foreign Investor Should Know

Dubai’s real estate market continues to attract foreign investors, high-net-worth individuals, and global entrepreneurs. The city offers strong rental income potential, no income tax, and long-term capital growth. However, before purchasing property in Dubai, it’s crucial to understand the difference between freehold and leasehold properties. Choosing

Continue ReadingWhat Entrepreneurs Must Know About ESR Rules in the UAE

Global entrepreneurs and internationally minded investors have long gravitated toward the UAE for its zero-tax reputation, free zones, and strategic location. But with increasing pressure from international bodies like the OECD and EU to crack down on harmful tax practices, the UAE has evolved, shifting from

Continue ReadingAI Is Revolutionizing Global Tax Planning

Artificial Intelligence (AI) and automation are now revolutionizing how tax professionals, accounting firms, and global businesses manage their tax and accounting functions. From identifying compliance risks to enabling tax optimization across jurisdictions, AI-powered tools and intelligent solutions are dramatically reshaping the tax world. Moreover, if you’re a tax

Continue ReadingLegal Tax Avoidance Strategies for Small Businesses in 2025

Legal tax avoidance strategies for small business owners are crucial for staying competitive in today’s market. By using legal tax avoidance strategies for small business owners, you can effectively minimize your tax obligations and maximize profits. Legal tax avoidance strategies not only help with reducing taxable

Continue Reading