Legally Reduce Taxes Through Real Estate Investing in Dubai

Property tax in Dubai like the real estate is not just about acquiring properties or generating rental income, it’s also one of the most effective ways to legally reduce your tax bill. Whether you’re an entrepreneur, high-net-worth individual, or seasoned property investor, real estate investments offer

Continue ReadingVisa Options for Entrepreneurs in Dubai: Tips and Eligibility

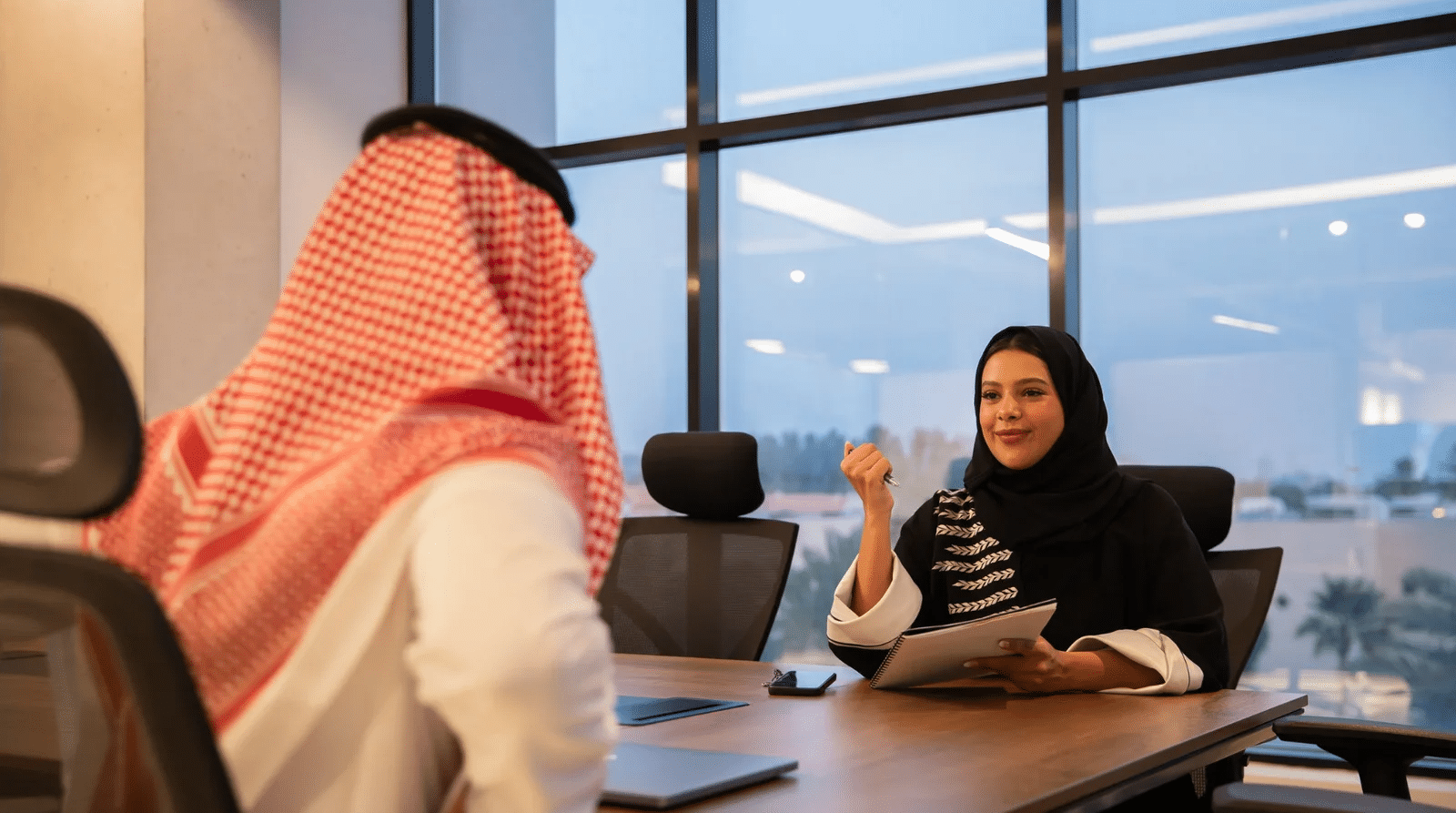

But to fully unlock everything Dubai has to offer, you need the right visa. Choosing the ideal visa ensures not only seamless operations for your business but also a stable and rewarding life for you and your family. This guide dives deep into the visa options

Continue ReadingTop 5 Places to Buy Property in Dubai for Long-Term Growth

Dubai’s real estate market remains one of the most dynamic and attractive in the Middle East. With its strategic location, investor-friendly regulations, and rapid urban development, Dubai continues to draw interest from both local and international property buyers. As we look ahead to 2025, the demand

Continue ReadingHow Much Does It Cost to Start a Business in Dubai?

Starting a business in Dubai in 2025 is more than just a smart move, it’s a gateway to global expansion, cutting-edge infrastructure, and 0% personal income tax. However, your success starts with knowing the true cost of setting up. Whether you’re looking at the mainland, a

Continue ReadingTop 10 Business Opportunities in Dubai to Explore in 2025

Business opportunities in Dubai abound, driven by the emirate’s dynamic economy and strategic location at the crossroads of Europe, Asia, and Africa, creating a thriving ecosystem that attracts entrepreneurs and investors worldwide. Moreover, with its business-friendly policies, tax advantages, world-class infrastructure, and diverse free zones,

Continue ReadingWhat Entrepreneurs Must Know About ESR Rules in the UAE

Global entrepreneurs and internationally minded investors have long gravitated toward the UAE for its zero-tax reputation, free zones, and strategic location. But with increasing pressure from international bodies like the OECD and EU to crack down on harmful tax practices, the UAE has evolved, shifting from

Continue ReadingHow to Open a Bank Account in Dubai in 2025: A Complete Guide

Dubai has cemented itself as a global financial hub, offering world-class banking services tailored to individuals, entrepreneurs, and businesses. Whether you’re looking for a savings account, a corporate bank account, or planning offshore banking, understanding the account opening process is key to unlocking Dubai’s financial benefits.

Continue ReadingLegal Tax Avoidance Strategies for Small Businesses in 2025

Legal tax avoidance strategies for small business owners are crucial for staying competitive in today’s market. By using legal tax avoidance strategies for small business owners, you can effectively minimize your tax obligations and maximize profits. Legal tax avoidance strategies not only help with reducing taxable

Continue ReadingUAE vs. Switzerland: Which Is the Better Haven for Your Wealth in 2025?

As global economic shifts accelerate, high-net-worth individuals (HNWIs), international businesses, and foreign investors are reassessing where to base their wealth. In the UAE vs Switzerland wealth tax haven 2025 comparison, both countries offer powerful advantages for asset protection, favorable tax policies, and international banking privacy. In

Continue ReadingLegally Reduce Corporate Taxes and Keep More of Your Profits

Tax season often brings anxiety, especially for entrepreneurs, small business owners, and self-employed individuals who juggle multiple financial priorities. But did you know that many business owners pay federal income taxes unnecessarily due to missed opportunities for tax deductions, poor tax planning, or using the wrong

Continue Reading